While following quarantine and social-distancing recommendations or requirements can help stop the spread of COVID-19, if you don't take proper precautions, your mental well-being could also suffer. Use the following tips to help maintain good mental health while you discover living with a new normal.

Keep a Routine

One of the best things that you can do to preserve your mental well-being is to stick to a routine. For example, if you're used to going to the gym before work, try to wake up early and get an at-home workout in before you go to work or start working at home.

Maintaining as much normalcy as possible with your daily routine can help keep your mood as lifted as possible and prevent boredom and distress from taking over.

If you have children who will be at home now, then creating a routine for them is also important. Implement a structured schedule for them, whether they are practicing virtual learning with their schools or if they are just at home, so they know what your expectations are. Try to limit screen time as much as possible and incorporate learning activities throughout the day.

Get a Good Night's Sleep

This goes hand-in-hand with sticking to a routine. While you're at home, it can be easy to go to bed or sleep in later than you typically would. Breaking your normal sleep pattern can have negative effects on your overall mental well-being, so try to stick to your usual sleep schedule.

Spend Time Outside

Unless health officials give explicit instructions to stay home no matter what, try to get outside periodically throughout the day. This could involve going out in your backyard or taking a walk around the block, but it shouldn't include going to a busy park or other areas where groups of people may be.

Being outside also helps to promote higher levels of vitamin D, which the body makes when skin is directly exposed to the sun. Many people are deficient in vitamin D, so exercising outside can be a great way to correct that.

Leverage the Power of Technology

When in quarantine or self-isolation, feeling lonely is common. Fortunately, advancements in technology have made it easy to connect with others without having to be in physical contact with or in close proximity to them. The Substance Abuse and Mental Health Services Administration (SAMHSA) recommends using technology to reach out to loved ones to reduce feelings of loneliness and anxiety, and to supplement your social life while you're quarantining or social distancing. If you're feeling down, use video-calling technology or social media to get in touch with friends and family.

Don't Obsess over the News

It can be easy to become overwhelmed by watching the news and reviewing the updates of the COVID‑19 situation. While it's important to be informed, you should not obsess over the news. For example, instead of monitoring the news all day from home, consider checking for updates once in the morning and once at night.

Practice Positivity and Gratitude

Taking five minutes a day to write down the things you're grateful for has been proven to lower stress levels and can help you change your mindset from negative to positive. While you're quarantining or social distancing, it's important to build time into your routine to practice positivity or express gratitude, to improve your mindset and boost your mood.

Conclusion

Your mental well-being plays a huge role in your physical health and well-being, and it should be prioritized.

These six suggestions can help you maintain your mental well-being during a quarantine, but shouldn't be considered medical advice.

If you have concerns about your mental well-being while you're in quarantine, please contact your mental health professional or use the Substance Abuse and Mental Health Services Administration's national helpline by calling (800) 662-HELP (800-622-4357)

On March 27, 2020, the president signed into law the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). This $2 trillion aid package will provide financial aid to families and businesses impacted by the coronavirus, or COVID-19, pandemic.

The CARES Act provides direct government payments to eligible Americans to offset the economic impact of the virus. The Treasury Department and the IRS have announced that distribution of these Economic Impact Payments (EIRs) will begin in April 2020. For most people, no action will be required. Official IRS information about the coronavirus pandemic and EIPs can be found on the IRS Coronavirus Tax Relief page.

When will I receive my payment?

If you are eligible (more on that below), you may expect to receive your payment as soon as the middle of April, according to the Treasury Department.

How will I know if I am eligible? How large a payment will I receive?

The IRS is responsible for determining eligibility for Economic Impact Payments.

U.S. residents will receive Economic Impact Payments of up to $1,200 for individual or head of household tax filers, and up to $2,400 for married couples filing jointly. Parents also receive $500 for each qualifying child. Filers with adjusted gross income below the thresholds specified below will receive a full payment.

- $75,000 for individuals

- $112,500 for head of household filers

- $150,000 for married couples filing joint returns

Taxpayers will receive a reduced payment if their adjusted gross income is between:

- $75,000 and $99,000 if their filing status is single or married filing separately

- $112,500 and $136,500 for heads of household

- $150,000 and $198,000 if their filing status is married filing jointly

Taxpayers above the maximum thresholds indicated above will receive no payment.

Payment calculations will be based on taxpayers' 2019 returns or on their 2018 returns if they have not yet filed for 2019. (The 2019 filing and payment deadline has been delayed from April 15 until July 15.)

To qualify for a payment, an individual must have a work-eligible Social Security number and must not be claimed as a dependent by another taxpayer in the current tax year. Lower-income individuals who are not subject to income tax will also receive payments.

For complete eligibility information, please visit the IRS website.

Will college students be eligible to receive a payment?

A college student who is claimed as a dependent on the tax return of a parent is not be eligible for a payment, though a financially independent student would be. For complete eligibility information, please visit the IRS website.

How will I receive my payment? Will it be sent as a paper check or electronically?

Most individuals will receive their payment electronically. This is faster and safer than mass distribution of paper checks.

If you filed taxes in 2018 or 2019 and provided on your tax return your bank routing and account number for payments or refunds, and this information has not changed, the IRS has the information it needs to send your payment electronically, with no action required on your part.

If you are a Social Security recipient, the IRS will use the direct deposit information held by the Social Security Administration. If the direct deposit information you have provided in the past is for a bank-issued, prepaid debit card, you will receive your funds on that card account.

If the IRS does not have your information on file and you are not a Social Security recipient, a check will be mailed to you. Check payments will be distributed weeks or possibly months after the direct deposits are sent. For additional information, please visit the IRS website.

To receive payment more quickly, we strongly recommend you file a 2019 tax return and provide direct deposit information.

If you do not typically file a tax return because you are not required to do so (for example, you may have low income or receive veterans disability compensation, a pension, or survivor benefits from the Department of Veterans Affairs), the IRS has created an online portal, called “Non-Filers: Enter Payment Info,” for the provision of direct deposit information. Visit this link to do so.

I file a tax return every year, but the IRS does not have my current information on file. Can I receive my payment electronically?

Yes. The IRS is planning to create a new, online portal called “Get My Payment” where people can obtain details about their payment and provide direct deposit information if the IRS does not already have it. At this time, the IRS online portal is under development. For updated information, please visit the IRS website.

The IRS has extended the tax-filing deadline this year from April 15 to July 15. If you file your 2019 taxes as soon as possible with your bank routing and account number on the form, the IRS may be able to use that information to send you an electronic payment.

What if I am typically not required to file a tax return?

Social Security recipients who have not been required to file tax returns will not be required to do so to receive their payments. People who typically do not file a tax return and are not Social Security beneficiaries will need to provide their information to the IRS at the website referenced in Question 4 above, “Non-Filers: Enter Payment Info.”

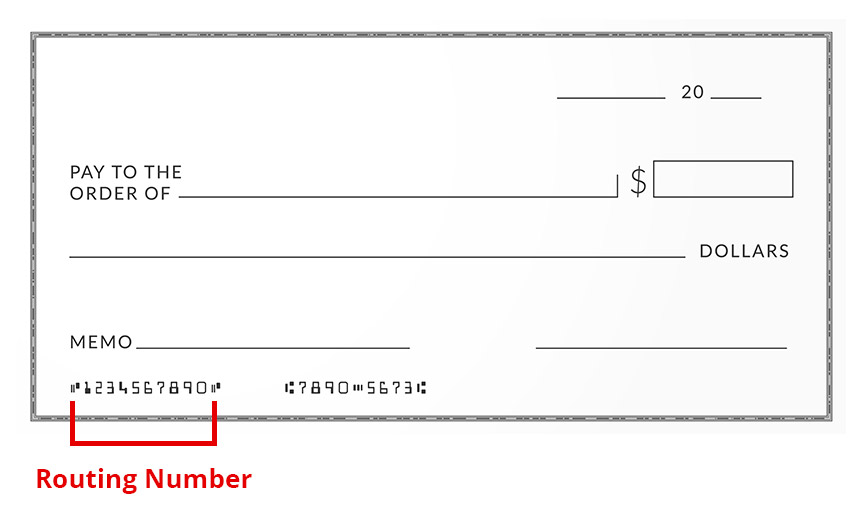

What is a bank routing and account number?

Bank routing and account numbers are used to direct payments to the right bank account at the right financial institution. If you have a checking account at a financial institution, the information is on the paper check. The bank routing number is on the lower left-hand side of the check and tells Treasury the correct bank to send the payment. Your individual account number is to the right of the routing number. That tells the bank to credit your specific account. Bank-issued reloadable prepaid debit card accounts have the same numbers, but the way they are provided to you will vary.

How do I find my bank routing and account number if I don't have checks?

Log in to your bank account online or through your bank's mobile app. Bank routing and account numbers may be located in different places, depending on your bank. If you can't find it easily, search “bank routing” within the app or website. If you still can't find the information or can't log on, call your bank for more information. Please remember banks will not provide your account number over the phone in order to safeguard your account from fraudsters.

New Tripoli Bank's routing number is 031312796. If you are having trouble finding your account number, you can contact the bank toll-free at (888) 298-8821.

If I have a reloadable prepaid card with a bank, can I direct the payment to that account?

Yes, follow the same instructions to gather the routing and bank account numbers to provide via the IRS online portal.

If I have a bank account, can I still receive a paper check?

Yes, but be aware that your payment will be slower than an electronic transfer. Paper checks may be sent out weeks after the electronic checks are sent. Many customers will prefer depositing the check through remote deposit capture. If your bank offers this service, you can take a picture of your check through your bank's smartphone app to make the deposit from the comfort and safety of your home the same day the check arrives in the mail. Alternatively, you can make the deposit at your bank's ATM. If you want to deposit the check in person, you may be required to visit a bank drive-through location because many bank branches are temporarily closed or offering restricted hours due to the pandemic. Check your bank's website for hours of operation.

New Tripoli Bank's hours of operation can be found here.

I don't have a bank account, but I want to receive my money faster. What can I do?

Some banks will open accounts for customers online without requiring an in-person visit to a bank branch. Search online for banks that offer digital account opening. Please check with the bank to understand all of the terms and conditions of opening an account online. Another option is a bank-issued reloadable prepaid card, which may be used to accept a direct deposit. These cards are available at retailers that partner with a bank. Please make sure that the card is “reloadable” in order to receive a direct deposit payment. After opening the account, you will be provided with a bank routing and account number to provide to the IRS.

What should I do to prevent fraudsters from accessing my funds?

A large amount of funds will be disbursed in the coming weeks to qualifying individuals. Accordingly, there is a risk for fraud of various types. The IRS has announced various ways individuals can be on guard against fraudulent activities. Click here to read the notice from the IRS.

It is important to remember that banks or the federal government will never contact you by telephone, text or email asking for your account information. Do not provide any banking information to anyone claiming to be “registering you for your relief payment.” This is a red flag.

For security reasons, the IRS plans to mail letters about Economic Impact Payments to taxpayers' last known address within 15 days after the payment is paid. The letter will provide information on how the payment was made and how to report any failure to receive the payment. If you are unsure you are receiving a legitimate letter, the IRS urges you to visit IRS.gov to protect yourself against fraudsters.

What should I do if I receive an unsolicited email or text appearing to be from the IRS?

Those who receive unsolicited emails, text messages or social media contacts attempting to gather information that appear to be from either the IRS or an organization closely linked to the IRS, such as the Electronic Federal Tax Payment System (EFTPS), should forward them to phishing@irs.gov. Taxpayers are encouraged not to engage potential fraudsters online or on the phone. Learn more about reporting suspected scams by going to the Report Phishing and Online Scams page on IRS.gov.

What Is Social Distancing?

Social distancing is a way to keep people from interacting closely or frequently enough to spread an infectious disease. Schools and other gathering places such as movie theaters may close, and sports events and religious services may be cancelled.

What Is Quarantine?

Quarantine separates and restricts the movement of people who have been exposed to a contagious disease to see if they become sick. It lasts long enough to ensure the person has not contracted an infectious disease.

What Is Isolation?

Isolation prevents the spread of an infectious disease by separating people who are sick from those who are not. It lasts as long as the disease is contagious.

What to Expect: Typical Reactions

Everyone reacts differently to stressful situations, such as an infectious disease outbreak, that require social distancing, quarantine, or isolation. People may feel:

Anxiety, worry, or fear related to:

- Their own health status

- The health status of others whom they may have exposed to the disease

- The resentment that friends and family may feel if they need to go into quarantine as a result of contact

- The experience of monitoring themselves, or being monitored by others for signs and symptoms of the disease

- Time taken off from work and the potential loss of income and job security

- The challenges of securing things they need, such as groceries and personal care items

- Concern about being able to effectively care for children or others

- Uncertainty or frustration about how long they will need to remain in this situation, and uncertainty about the future

- Loneliness associated with feeling cut off from the world and from loved ones

- Anger if they think they were exposed to the disease because of others’ negligence

- Boredom and frustration because they may not be able to work or engage in regular day-to-day activities

- Uncertainty or ambivalence about the situation

- A desire to use alcohol or drugs to cope

- Symptoms of depression, such as feelings of hopelessness, changes in appetite, or sleeping too little or too much

- Symptoms of post-traumatic stress disorder (PTSD), such as intrusive distressing memories, flashbacks (reliving the event), nightmares, changes in thoughts and mood, and being easily startled

If you or a loved one experience any of these reactions over a period of two to four weeks or longer, contact your health care provider or one of the resources at the end of this article.

Ways to Support Yourself during Social Distancing, Quarantine, and Isolation

Understand the Risk

Consider the real risk of harm to yourself and others around you. The public perception of risk during a situation such as an infectious disease outbreak is often inaccurate. Media coverage may create the impression that people are in immediate danger when really the risk for infection may be very low. Take steps to get the facts:

- Stay up to date on what is happening, while limiting your media exposure. Avoid watching or listening to news reports 24/7 since this tends to increase anxiety and worry. Remember that children are especially affected by what they hear and see on television.

- Look to credible sources for information on the infectious disease outbreak:

Centers for Disease Control and Prevention

1600 Clifton Road

Atlanta, GA 30329-4027

1 (800) 232-4636

http://www.cdc.gov

World Health Organization

Regional Office for the Americas of the World Health Organization

525 23rd Street

NW Washington, DC 20037

(202) 974-3000

http://www.who.int/en

Be Your Own Advocate

Speaking out about your needs is particularly important if you are in quarantine, since you may not be in a hospital or other facility where your basic needs are met. Ensure you have what you need to feel safe, secure, and comfortable.

- Work with local, state, or national health officials to find out how you can arrange for groceries and toiletries to be delivered to your home as needed.

- Inform health care providers or health authorities of any needed medications and work with them to ensure that you continue to receive those medications.

Educate Yourself

Health care providers and health authorities should provide information on the disease, its diagnosis, and treatment.

- Do not be afraid to ask questions—clear communication with a health care provider may help reduce any distress associated with social distancing, quarantine, or isolation.

- Ask for written information when available.

- Ask a family member or friend to obtain information in the event that you are unable to secure this information on your own.

Work With Your Employer to Reduce Financial Stress

If you’re unable to work during this time, you may experience stress related to your job status or financial situation.

- Provide your employer with a clear explanation of why you are away from work.

- Contact the U.S. Department of Labor toll-free at 1 (866) 487-2365 about the Family and Medical Leave Act (FMLA), which allows U.S. employees up to twelve weeks of unpaid leave for serious medical conditions, or to care for a family member with a serious medical condition.

- Contact your utility providers, cable and Internet provider, and other companies from whom you get monthly bills to explain your situation and request alternative bill payment arrangements as needed.

Connect With Others

Reaching out to people you trust is one of the best ways to reduce anxiety, depression, loneliness, and boredom during social distancing, quarantine, and isolation. You can:

- Use the telephone, email, text messaging, and social media to connect with friends, family, and others.

- Talk “face to face” with friends and loved ones using Skype or FaceTime.

- If approved by health authorities and your health care providers, arrange for your friends and loved ones to bring you newspapers, movies, and books.

- Sign up for emergency alerts via text or email to ensure you get updates as soon as they are available.

- Call the Substance Abuse and Mental Health Services Administration’s (SAMHSA) free 24-hour Disaster Distress Helpline at 1 (800) 985-5990, if you feel lonely or need support.

- Use the Internet, radio, and television to keep up with local, national, and world events.

- If you need to connect with someone because of an ongoing alcohol or drug problem, consider calling your local Alcoholics Anonymous or Narcotics Anonymous offices.

Talk to Your Doctor

If you are in a medical facility, you may have access to health care providers who can answer your questions. However, if you are quarantined at home and you’re worried about physical symptoms you or your loved ones may be experiencing, call your doctor or other health care provider.

- Ask your provider whether it would be possible to schedule remote appointments via Skype or FaceTime for mental health, substance use, or physical health needs.

- In the event that your doctor is unavailable and you are feeling stressed or are in crisis, call the hotline numbers listed at the end of this tip sheet for support.

Use Practical Ways to Cope and Relax

- Relax your body often by doing things that work for you-take deep breaths, stretch, meditate or pray, or engage in activities you enjoy.

- Pace yourself between stressful activities and do something fun after a hard task.

- Talk about your experiences and feelings to loved ones and friends, if you find it helpful.

- Maintain a sense of hope and positive thinking; consider keeping a journal where you write down things you are grateful for or that are going well.

After Social Distancing, Quarantine, or Isolation

You may experience mixed emotions, including a sense of relief. If you were isolated because you had the illness, you may feel sadness or anger because friends and loved ones may have unfounded fears of contracting the disease from contact with you, even though you have been determined not to be contagious.

The best way to end this common fear is to learn about the disease and the actual risk to others. Sharing this information will often calm fears in others and allow you to reconnect with them.

If you or your loved ones experience symptoms of extreme stress—such as trouble sleeping, problems with eating too much or too little, inability to carry out routine daily activities, or using drugs or alcohol to cope—speak to a health care provider or call one of the hotlines listed to the right for a referral.

If you are feeling overwhelmed with emotions such as sadness, depression, anxiety, or feel like you want to harm yourself or someone else, call 911 or the National Suicide Prevention Lifeline at 1 (800) 273- 8255.

Helpful Resources Hotlines

Substance Abuse and Mental Health Services Administration’s (SAMHSA) Disaster Distress Helpline

Toll-Free: 1 (800) 985-5990 (English and español)

SMS: Text TalkWithUs to 66746

SMS (español): “Hablanos” al 66746

TTY: 1 (800) 846-8517

Website (English): http://www.disasterdistress.samhsa.gov

Website (español): https://www.samhsa.gov/find-help/disaster-distress-helpline/espanol

SAMHSA’s National Helpline

Toll-Free: 1 (800) 662-HELP (24/7/365 Treatment Referral Information Service in English and español)

Website: http://www.samhsa.gov/find-help/national-helpline

National Suicide Prevention Lifeline

Toll-Free (English): 1 (800) 273-8255

Toll-Free (español): 1 (888) 628-9454

TTY: 1 (800) 799-4889

Website (English): http://www.suicidepreventionlifeline.org

Website (español): http://www.suicidepreventionlifeline.org/gethelp/spanish.aspx

Treatment Locator

Behavioral Health Treatment Services Locator Website: http://findtreatment.samhsa.gov/locator/home

For help finding treatment call 1 (800) 662-4357 or visit https://findtreatment.gov/

SAMHSA Disaster Technical Assistance Center

Toll-Free: 1 (800) 308-3515

Email: DTAC@samhsa.hhs.gov

Website: http://www.samhsa.gov/dtac

Updated 3/23/2020

What is coronavirus disease 2019 (COVID-19)?

Coronavirus disease 2019 (COVID-19) is a respiratory illness that can spread from person to person. The virus that causes COVID-19 is a novel coronavirus that was first identified during an investigation into an outbreak in Wuhan, China.

How many cases of COVID-19 have been reported in the U.S.?

The first case of COVID-19 in the United States was reported on January 21, 2020. The current count of cases of COVID-19 in the United States is available on CDC’s webpage at https://www.cdc.gov/coronavirus/2019-ncov/cases-in-us.html

How does COVID-19 spread?

Person-to-person spread

The virus is thought to spread mainly from person-to-person.

- Between people who are in close contact with one another (within about 6 feet).

- Through respiratory droplets produced when an infected person coughs or sneezes.

These droplets can land in the mouths or noses of people who are nearby or possibly be inhaled into the lungs.

Can someone spread the virus without being sick?

- People are thought to be most contagious when they are most symptomatic (the sickest).

- Some spread might be possible before people show symptoms; there have been reports of this occurring with this new coronavirus, but this is not thought to be the main way the virus spreads.

Spread from contact with contaminated surfaces or objects

It may be possible that a person can get COVID-19 by touching a surface or object that has the virus on it and then touching their own mouth, nose, or possibly their eyes, but this is not thought to be the main way the virus spreads.

How easily the virus spreads

How easily a virus spreads from person-to-person can vary. Some viruses are highly contagious (spread easily), like measles, while other viruses do not spread as easily. Another factor is whether the spread is sustained, spreading continually without stopping.

The virus that causes COVID-19 seems to be spreading easily and sustainably in the community (“community spread”) in some affected geographic areas.

What are the symptoms of COVID-19?

Reported illnesses have ranged from mild symptoms to severe illness and death for confirmed coronavirus disease 2019 (COVID-19) cases.

These symptoms may appear 2-14 days after exposure (based on the incubation period of MERS-CoV viruses).

- Fever

- Cough

- Shortness of breath

If you develop emergency warning signs for COVID-19 get medical attention immediately. Emergency warning signs include*:

- Trouble breathing

- Persistent pain or pressure in the chest

- New confusion or inability to arouse

- Bluish lips or face

*This list is not all inclusive. Please consult your medical provider for any other symptoms that are severe or concerning.

What are severe complications from this virus?

Some patients have pneumonia in both lungs, multi-organ failure and in some cases death.

What should I do if I recently traveled from an area with ongoing spread of COVID-19?

If you have traveled from an affected area, there may be restrictions on your movements for up to 2 weeks. If you develop symptoms during that period (fever, cough, trouble breathing), seek medical advice. Call the office of your health care provider before you go, and tell them about your travel and your symptoms. They will give you instructions on how to get care without exposing other people to your illness. While sick, avoid contact with people, don’t go out and delay any travel to reduce the possibility of spreading illness to others.

Is there a vaccine?

There is currently no vaccine to protect against COVID-19. The best way to prevent infection is to take everyday preventive actions, like avoiding close contact with people who are sick and washing your hands often.

Is there a treatment?

There is no specific antiviral treatment for COVID-19. People with COVID-19 can seek medical care to help relieve symptoms.

What to do if you are sick with coronavirus disease 2019 (COVID-19)

If you are sick with COVID-19 or suspect you are infected with the virus that causes COVID-19, follow the steps below to help prevent the disease from spreading to people in your home and community.

Stay home except to get medical care

- Stay home: People who are mildly ill with COVID-19 are able to recover at home. Do not leave, except to get medical care. Do not visit public areas.

- Stay in touch with your doctor. Call before you get medical care. Be sure to get care if you feel worse or you think it is an emergency.

- Avoid public transportation: Avoid using public transportation, ride-sharing, or taxis.

Separate yourself from other people and animals in your home

- Stay away from others: As much as possible, you should stay in a specific “sick room” and away from other people in your home. Use a separate bathroom, if available.

- Limit contact with pets and animals: You should restrict contact with pets and other animals, just like you would around other people.

- Although there have not been reports of pets or other animals becoming sick with COVID-19, it is still recommended that people with the virus limit contact with animals until more information is known.

- When possible, have another member of your household care for your animals while you are sick with COVID-19. If you must care for your pet or be around animals while you are sick, wash your hands before and after you interact with them. See COVID-19 and Animals for more information.

Call ahead before visiting your doctor

If you have a medical appointment, call your doctor’s office or emergency department, and tell them you have or may have COVID-19. This will help the office protect themselves and other patients.

Wear a facemask

- If you are sick: You should wear a facemask when you are around other people and before you enter a healthcare provider’s office.

- If you are caring for others: If the person who is sick is not able to wear a facemask (for example, because it causes trouble breathing), then people who live in the home should stay in a different room. When caregivers enter the room of the sick person, they should wear a facemask. Visitors, other than caregivers, are not recommended.

Cover coughs and sneezes

- Cover: Cover your mouth and nose with a tissue when you cough or sneeze.

- Dispose: Throw used tissues in a lined trash can.

- Wash hands: Immediately wash your hands with soap and water for at least 20 seconds. If soap and water are not available, clean your hands with an alcohol-based hand sanitizer that contains at least 60% alcohol.

Avoid sharing personal household items

- Do not share: Do not share dishes, drinking glasses, cups, eating utensils, towels, or bedding with other people in your home.

- Wash thoroughly after use: After using these items, wash them thoroughly with soap and water or put in the dishwasher.

Clean your hands often

- Wash hands: Wash your hands often with soap and water for at least 20 seconds. This is especially important after blowing your nose, coughing, or sneezing; going to the bathroom; and before eating or preparing food.

- Hand sanitizer: If soap and water are not available, use an alcohol-based hand sanitizer with at least 60% alcohol, covering all surfaces of your hands and rubbing them together until they feel dry.

- Soap and water: Soap and water are the best option, especially if hands are visibly dirty.

- Avoid touching: Avoid touching your eyes, nose, and mouth with unwashed hands.

Avoid close contact

- Avoid close contact with people who are sick

- Put distance between yourself and other people if COVID-19 is spreading in your community. This is especially important for people who are at higher risk of getting very sick.

Clean and disinfect

- Clean AND disinfect frequently touched surfaces daily. This includes tables, doorknobs, light switches, countertops, handles, desks, phones, keyboards, toilets, faucets, and sinks.

- If surfaces are dirty, clean them: Use detergent or soap and water prior to disinfection.

To disinfect:

Most common EPA-registered household disinfectants will work. Use disinfectants appropriate for the surface.

Options include:

- Diluting your household bleach.

To make a bleach solution, mix:- 5 tablespoons (1/3rd cup) bleach per gallon of water

OR - 4 teaspoons bleach per quart of water

Follow manufacturer’s instructions for application and proper ventilation. Check to ensure the product is not past its expiration date. Never mix household bleach with ammonia or any other cleanser. Unexpired household bleach will be effective against coronaviruses when properly diluted.

- 5 tablespoons (1/3rd cup) bleach per gallon of water

- Alcohol solutions.

Ensure solution has at least 70% alcohol. - Other common EPA-registered household disinfectants.

Products with EPA-approved emerging viral pathogens pdf icon[7 pages]external icon claims are expected to be effective against COVID-19 based on data for harder to kill viruses. Follow the manufacturer’s instructions for all cleaning and disinfection products (e.g., concentration, application method and contact time, etc.).

Monitor your symptoms

- Seek medical attention, but call first: Seek medical care right away if your illness is worsening (for example, if you have difficulty breathing).

- Call your doctor before going in: Before going to the doctor’s office or emergency room, call ahead and tell them your symptoms. They will tell you what to do.

- Wear a facemask: If possible, put on a facemask before you enter the building. If you can’t put on a facemask, try to keep a safe distance from other people (at least 6 feet away). This will help protect the people in the office or waiting room.

- Follow care instructions from your healthcare provider and local health department: Your local health authorities will give instructions on checking your symptoms and reporting information.

If you develop emergency warning signs for COVID-19 get medical attention immediately. Emergency warning signs include*:

- Difficulty breathing or shortness of breath

- Persistent pain or pressure in the chest

- New confusion or inability to arouse

- Bluish lips or face

*This list is not all inclusive. Please consult your medical provider for any other symptoms that are severe or concerning.

Call 911 if you have a medical emergency: If you have a medical emergency and need to call 911, notify the operator that you have or think you might have, COVID-19. If possible, put on a facemask before medical help arrives.

Discontinuing home isolation

- People with COVID-19 who have stayed home (home isolated) can stop home isolation under the following conditions:

- If you will not have a test to determine if you are still contagious, you can leave home after these three things have happened:

- You have had no fever for at least 72 hours (that is three full days of no fever without the use medicine that reduces fevers)

AND - other symptoms have improved (for example, when your cough or shortness of breath have improved)

AND - at least 7 days have passed since your symptoms first appeared

- You have had no fever for at least 72 hours (that is three full days of no fever without the use medicine that reduces fevers)

- If you will be tested to determine if you are still contagious, you can leave home after these three things have happened:

- You no longer have a fever (without the use medicine that reduces fevers)

AND - other symptoms have improved (for example, when your cough or shortness of breath have improved)

AND - you received two negative tests in a row, 24 hours apart. Your doctor will follow CDC guidelines.

- You no longer have a fever (without the use medicine that reduces fevers)

- If you will not have a test to determine if you are still contagious, you can leave home after these three things have happened:

In all cases, follow the guidance of your healthcare provider and local health department. The decision to stop home isolation should be made in consultation with your healthcare provider and state and local health departments. Local decisions depend on local circumstances.

More information is available here.

Rebuilding after a disaster or emergency can be a difficult challenge for people at every level of income. In these stressful situations, having easy access to your personal financial, insurance, medical, and other records is key to beginning the rebuilding process as quickly as possible. Taking the time now to collect and protect your critical documents will pay off in the future, giving you peace of mind and, in the event of an emergency, ensure you are ready to start rebuilding as soon as possible with all the necessary information.

Look over the following list and confirm you have taken all these steps to prepare for an emergency:

- Collect all financial and critical personal, household, and medical documents and maintain it in a secure location, readily accessible.

- Establish an emergency fund that can be accessed in times of crisis. This could mean keeping a small amount of cash at home in a secure place in case you can't get access to your bank accounts.

- Obtain property (homeowners or renters), health, and life insurance if you do not have them already. Review your policy to ensure you're covered in the event of all possible emergencies. For example: standard homeowners insurance often will not cover flooding, so you may need to purchase separate flood insurance from the National Flood Insurance Program.

- Make photo copies of all of your debit and credit cards and store them in a safe place so you have your account information at the ready in the event of an emergency.

- FEMA has an Emergency Financial First Aid Kit (EFFAK) with a wealth of information to help you prepare your emergency financial plan.

Emergency Financial First Aid Kit (EFFAK)

If there's anything we want you to take away from this article, it's how important it is to have a financial plan ready for an emergency. FEMA's Emergency Financial First Aid Kit (EFFAK) can help you prepare for surprises and reduce the financial impact of disasters that could otherwise hurt you, your family, or your business.

At Home

The EFFAK is an excellent guide to ensuring your personal financial preparedness, but you should also consider downloading a secure mobile app on your phone where you can store electronic copies of important documents for immediate access in the case of an emergency. You should also consider storing physical documents in a safe deposit box at your local financial institution if they offer those services.

The most important documents to have in an emergency are your financial and medical records which are critical to jump-start the recovery process. Take the time to make sure you have the following documents secured and accessible in the event of a disaster:

Household Identification

- Photo ID of all household residents

- Birth certificates

- Social Security card to apply for disaster assistance from FEMA

- Military service

- Pet ID tags

Financial and Legal Documentation

- Financial records and obligations

- Insurance policies

- Sources of income to maintain payments and credit

- Tax statements to provide contact information and apply for FEMA assistance

Medical Information

- Physician contact information in case medical care is needed

- Copies of health insurance information so care is not interrupted

- Immunization records

- Medication

Insurance Information

Purchasing insurance for your home or business property helps ensure you have the financial resources necessary to repair, rebuild, or replace whatever is damaged.

Household Contact Information

- Banking institutions

- Insurance agent

- Health professionals

- Service providers

- Place of worship

For Organizations

Businesses and other organizations are only as strong as their employees, which is why an employee or member's financial stress can have a ripple effect that could negatively impact your organization. You should encourage people throughout your organization or workplace to practice financial preparedness. Here are some ideas you can use to help promote emergency preparedness in your business or organization:

- Hold an informal lunch meeting to discuss financial preparedness.

- Organize a presentation for your next staff meeting.

- Include financial preparedness tips in your monthly staff newsletter.

Get Your Benefits Electronically

Disasters can disrupt mail service for days or even weeks at a time. If you rely on Social Security, pensions, or other regular benefits, you should consider switching to electronic payments to ensure your income is not interrupted by an emergency. This also eliminates the risk of checks being stolen from the mail. We recommend you consider these methods of payment instead of receiving physical mail:

- Set up direct deposit to your checking or savings account. Federal benefit recipients can sign up online or call (800) 333-1795.

- The Direct Express® prepaid debit card is designed as a safe and easy alternative to paper.

These tips and suggestions were taken from the Department of Homeland Security’s Financial Preparedness. You can learn more about how to prepare for disasters by visiting Ready.gov

As we say good-bye to the last decade and hello to 2020, it’s even more important to focus on planning for tomorrow. One of the best New Year’s resolutions you can make for yourself is to start establishing good credit habits and set financial wellness goals for yourself that will help you get back on the path to a prosperous financial future.

If personal finances are a house, then having good credit is the foundation. Whether your plan is to purchase a new home or start your own small business, you’ll need a loan to get there, and you won’t be able to get one without good credit!

Like anything in life, responsible credit practices are not something anyone is naturally good at. You have to work toward developing habits that demonstrate sound money management strategy. Remember; it’s much easier to build a credit score than repair a damaged one.

Enough introduction: what can you do to avoid costly missteps as you start on your journey to building and maintaining good credit?

- If you are just beginning to establish your credit history, open a checking account with your local community bank and make a habit out of keeping track of your balance. New Tripoli Bank has a free checking account to get you started and money management tools in our online banking platform.

- Instead of cash, use debit and credit cards for convenience and safety. However, make sure you don’t overspend! Missed or late payments can be damaging to your credit and will end up hurting your credit score.

- Try to maintain a varied mix of credit types (such as a revolving line of credit or an installment loan). Utilizing different types of credit shows your ability to manage your finances and will boost your credit score.

- Three to six months prior to making a major purchase, you should take extra care to demonstrate financial stability. Loan officers will feel more comfortable lending to you if you aren't opening and closing accounts or moving large amounts of money around, and avoiding these practices can mitigate stress after a large purchase.

- Build an emergency fund equal to at least six months of living expenses. That way, if the unexpected happens, you will still be able to pay fixed expenses without falling behind.

- As you reach different stages of life, you should alter your credit focus. Early in life you can take out loans on larger purchases such as automobiles and real estate, which will help you build credit, but as you near retirement you will want to make sure these major loans are paid down.

- Monitor your credit regularly to correct any errors and quickly detect signs of potential identity theft. Order a copy of your annual credit report from annualcreditreport.com. You can also sign up for credit monitoring services that will help protect your credit.

If you’re concerned about your credit or want help achieving financial milestones, you should contact your local community bank who is always ready to assist. Maintaining good spending and saving habits early can help you focus on your financial goals and make it easier for you to navigate life’s unexpected twists and turns.

The holidays are a time for spreading cheer and giving gifts to friends and loved ones. When you’re looking for the perfect gift this holiday season, it can be tempting to default to the internet. However, this holiday season, you should consider picking up a one-of-a-kind gift from your local small business instead.

“Why is that?” you might be asking. After all, the internet has made it easier than ever to find that popular new toy—the one that would have sold out in holidays past—and have it delivered to your home, not by Santa but by the postal service. However, it’s only slightly more difficult to drive to a local independent business to do your holiday shopping and, more importantly, buying a gift from a local small business is also a gift to your community.

Every dollar spent at independent businesses is money that stays in your community. Studies show that when you shop at smaller retailers, those business owners will spend that money locally as well, keeping the money in your community for longer. Small businesses are also the leading job creators in the United States, accounting for two out of every three new jobs created annually. That means your dollar ensures those small mom-n-pop stores will have the money to expand, modernize, and remain in business!

Perhaps you’re concerned about our impact on the environment. If so, you should absolutely choose to patronize independent local businesses, which typically consume less land, carry more locally-made products, and create less traffic and air pollution by not having to ship products over long distances.

However, the most important reason to commit to shopping locally this holiday is simple: the creations you find at small local shops are one-of-a-kind, unique gifts that you won’t find anywhere else, more memorable than whatever the hot new must-have toy or tech gadget is this year. Here’s an example: do you remember Tickle-Me-Elmo? You had probably forgotten about it after the year it was the hot toy for Christmas and hadn’t thought about it until I mentioned it just now. While these mass-produce products are fleeting, a hand-painted statue or a quilt with your family’s names on it will create a lasting memory your friends and family can enjoy.

Your “gift” doesn’t necessarily need to be a product. It could be an experience, like going to see a local band, taking your friends out to a fancy dining experience at a local family-run restaurant, or something as simple as a holiday event with family featuring food, drink, and entertainment bought from small independent businesses in your community.

Whatever your holiday plans are this year, it’s important you show your support for entrepreneurs and small businesses by using your dollar locally. We should all work to spread the holiday cheer and ensure our local business community can thrive!

Securing financing for your small business can feel like a monumental task. The daunting process of selecting a bank that will be right for your company and making an application, gathering the information to support the application and the interview process supporting the application can feel overwhelming. Not to mention after all of that, your loan may not be approved for the full amount, if at all!

Community banks help to remove the aggravation from this process through a friendlier, more personal and open-minded approach. Community banks are active participants in their communities through their contributions and their employees who live in the communities they serve. Community banks have skilled and well-trained employees who take a personal approach when dealing with business owners.

There are many advantages to applying for a loan through a community bank:

- Personalized Service – Many small businesses have unique needs that do not fit the “in the box” lending philosophy of larger banks. Community bankers take the time to make business owners feel welcome, rather than feeling like just an account number. In most cases, you will be working with the individual who will approve your loan instead of an unknown, out-of-state decision maker. Community banks were established to provide flexible financing catered to local business needs. You’re also likely to meet the executive management when applying for a small business loan through a community bank.

- Community Focus – Community banks rely on the health and growth of the communities they serve for their own success. Community banks support local organizations like Little Leagues, Scout Troops and food banks through contributions, employee volunteers and supporting the growth of local businesses. Some large commercial banks reject loans based on types of industries or loan size; community banks look to support all companies within the area they serve.

- Emphasizing Character – When assessing loan applications, community banks are more likely to consider the character of the business owner. The approval algorithms used by large banks cannot quantify character. Although financial results and collateral are the primary deciding factors for any bank, in many cases the assessment of character will be the deciding factor for community lenders.

- Flexible Lending – Community bankers seek to assist all businesses in their community while realizing that they cannot be “all things to all people.” Some large banks will not lend to certain industries or even consider loans that are too small. Business owners should not underestimate the lending power of the community bank, as many can provide loans in the five- to ten-million dollar range and provide technology-oriented products at competitive rates and nominal costs.

- Quick Turnaround – The lines of communication within a community bank are short and do not extend out-of-state. Community banks use rigorous underwriting, but their size allows for quick responses. The lender can focus on the request at hand rather than be out of the office selling the “product of the day” in order to make a bank dictated goal. At a community bank, the customer’s need is the only goal.

So you’ve heard the reasons why you should apply for your small business loan through a community bank and you’ve been convinced. Great! Now the question becomes: what do you need to do to prepare for a meeting with a commercial lender that will give you the best chance at being approved for a loan?

Like any good Boy Scout knows, before you apply for any small business loan you should “be prepared!” You should have the following:

- Two to three years of tax returns or financial statements

- The latest company-prepared interim financial statement

- A personal financial statement (listing personal assets and liabilities) for all of the owners of the company, as most small business loans will require the guarantee of the owners

- Be prepared to discuss the history and operation of the business

- Discuss why you need the loan and more importantly how the bank will be repaid

Having this information ready prior to the initial discussion allows the bank to make quick decisions and reduces the applicant’s aggravation.

Most banks large and small will have difficulty financing restaurants and start-up businesses (due to the lack of collateral and high failure rates). These types of requests are best served by area Small Business Development Centers (SBDC). Two are located at Lehigh University and Kutztown University and provide free help developing business plans and obtaining financing through the Small Business Administration (SBA).

Obtaining a small business loan can be daunting, but community banks offer the most reliable route to financing a local enterprise. As a small business themselves, community banks only thrive when their customers and communities flourish. With the proper preparation and approach, a community bank can provide you with the personal experience and support your business needs to succeed.

« Previous Page

Log In

Log In

Log into Online Banking

Log into Online Banking