Scam artists are impersonating the Department of Revenue by sending Pennsylvania business owners fraudulent letters in the mail that direct them to turn over their accounting records. The goal of this ploy is to trick unsuspecting taxpayers into providing sensitive financial information, which the criminals behind the scheme can use for a number of illicit activities that could seriously harm a business' financial standing.

"This is a prime example of fraudsters impersonating a government agency as they try to convince hardworking Pennsylvanians to turn over sensitive information about their businesses," Revenue Secretary Dan Hassell said. "We are urging Pennsylvania business owners to be on high alert if they receive a suspicious notice that includes the Department of Revenue name and logo. If you have any doubt at all about the legitimacy of a notice from the department, please use the contact information listed on our website, revenue.pa.gov. This is the best way to ensure you are speaking with a legitimate staff member at the Department of Revenue."

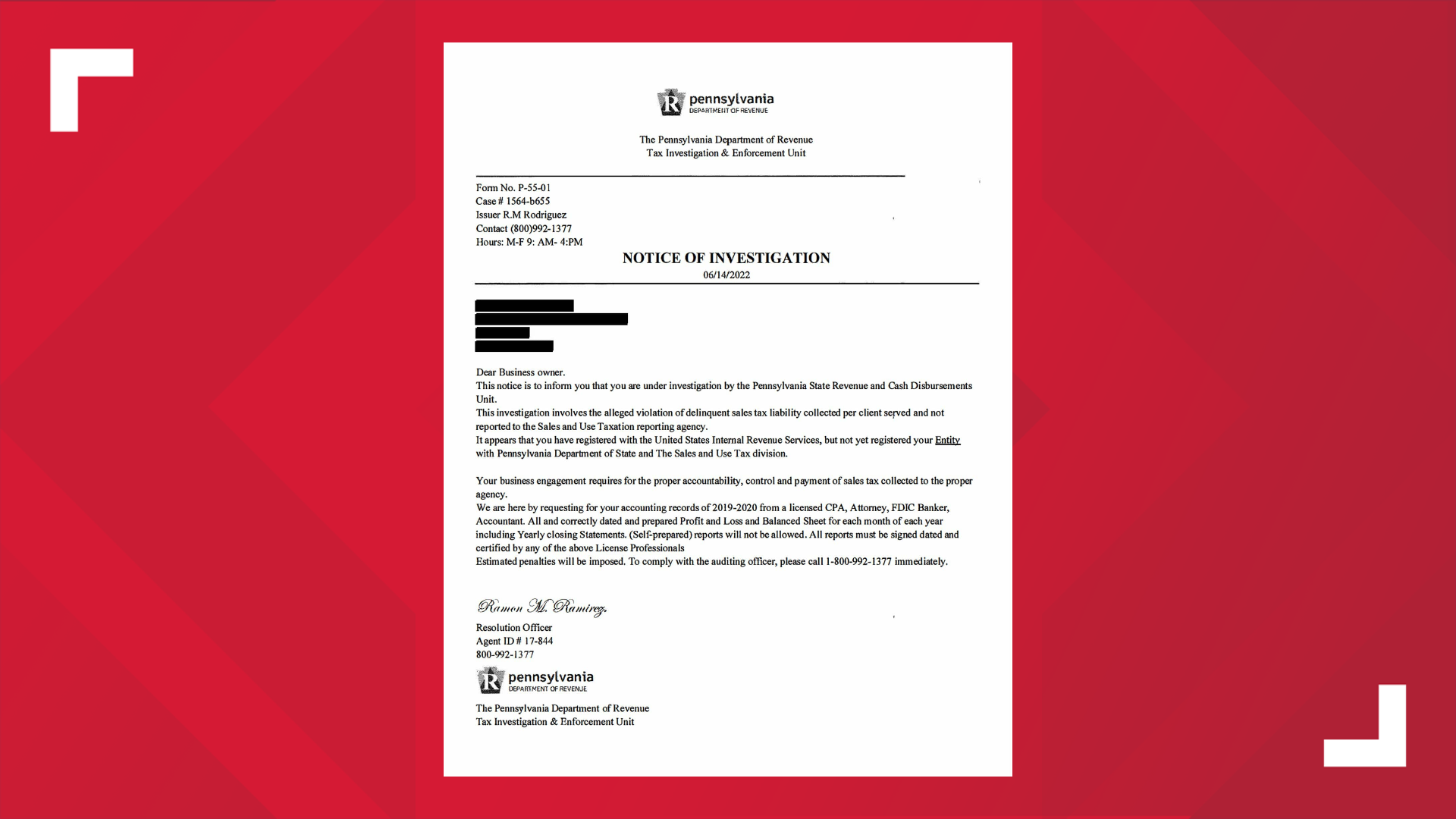

Understanding the Scam

The goal of this scam is to make the recipient of the letter believe they are being investigated by the Department of Revenue for an "alleged violation of delinquent sales tax liability." The letter also threatens taxpayers by saying penalties will be imposed on their accounts. Further, the letter includes contact information for a "Resolution Officer" and urges the business owner to provide accounting records prepared by a licensed professional, such as an attorney or CPA.

Providing this information allows the scammers to comb through the accounting records for sensitive information such as bank account numbers and other financial data, which could be used to make unauthorized transactions, request fraudulent tax refunds, and even apply for loans under the name of the business.

Although these counterfeit notices bear the department's name and logo, the notices include suspicious and inaccurate details that can help differentiate between a counterfeit notice sent by a scam artist and a legitimate notice sent by the Department of Revenue. Be on the lookout for notices that make dubious claims or include suspicious details. Here are some tips to keep in mind:

- The counterfeit notice does not include a return address. A notice from the Department of Revenue will always include an official Department of Revenue address as the return address.

- The counterfeit notice addresses the recipient as "Dear Business Owner." When the Department of Revenue attempts to contact a business through a notice in the mail, the notice typically addresses the business owner or business name.

- The counterfeit notice is sent by the "Pennsylvania Department of Revenue Tax Investigation & Enforcement Unit" and claims the business is "under investigation by the Pennsylvania State Revenue and Cash Disbursement Unit." While the department does conduct criminal tax investigations and tax enforcement, the units listed on the counterfeit notice are phony. Reach out to the department directly, as advised below, to determine if the "Unit" named exists.

- The counterfeit notice claims that the business has not registered their "entity with the Pennsylvania Department of State and The Sales and Use Tax Division." If you are an established business in Pennsylvania, it is likely that you already registered your business with the Pennsylvania Department of State and have registered for a sales tax license by completing the Department of Revenue's PA Online Business Entity Registration (PA-100).

Tips to Avoid This Scam

The Department of Revenue is encouraging Pennsylvanians to keep the following tips in mind to safeguard against this scam:

- Ensure You Are Speaking With Legitimate Representatives of the Department: This scam uses the Department of Revenue's name and logo to pose as a government entity. If you have any doubt at all about the legitimacy of a notice from the department, you should reach out to a department representative by using the Online Customer Service CenterOpens In A New Window. This allows the taxpayer to securely submit a question through a process that is very similar to sending an email.

- Examine the Notice: This counterfeit notice used vague language to cast a wide net to lure in as many victims as possible. Examine the notice for identifying information that can be verified. Look for blatant factual errors and other inconsistencies. If the notice is unexpected and demands immediate action, take a moment, and verify its legitimacy.

- Conduct Research Online: Use the information in a potentially counterfeit notice, such as a name, address or telephone number, to conduct a search online. The Department of Revenue's website, revenue.pa.gov, is the best source to verify information contained in a legitimate notice from the department.

Steps To Follow if You Have a Question

If you are concerned about a potentially fraudulent notice, please visit the department's Verifying contact by the Department of Revenue webpage for verified phone numbers and contact information. This will help you ensure that you are speaking with a legitimate representative of the department.

Ever since Amazon took off and Facebook launched its marketplace, it seems like the only way to shop is online. Scammers have taken notice and they are constantly trying new schemes to trick careless online shoppers out of money or their private information. The latest scam on the digital marketplace involves payment apps and phony buyers on the Facebook Marketplace who "need" you to update your Zelle, CashApp, or other digital wallet in order to accept money from them.

Here's how it works...

After listing a big-ticket item on the Facebook Marketplace, you are contacted by a buyer who wants to pay using a peer-to-peer payment app. While recent reports reference Zelle, this scam can involve any digital wallet like CashApp, Venmo, or any similar service.

Shortly after receiving a payment, you get an email supposedly from whichever app you used to transfer money. The email will claim the buyer paid via a "business account" and state that you need to upgrade your account to business status to accept the transfer. The "buyer" will offer to send more money to cover the costs of this upgrade as long as you promise to refund them, sending screenshots of their digital wallet with the money deducted from their account. Then the scammer will begin pressuring you into repaying them for these phony fees.

Here's the rub: the initial payment was never sent in the first place! You'll be out a few hundred dollars and the scammer will disappear.

How you avoid scams when selling online:

Don't trust anyone offering to overpay. Unless your item is particularly rare and receive multiple offers over the asking price, be wary of buyers offering you more than you're asking. People tend to shop online to save money, not overspend!

Check email addresses carefully. This goes for any email that you receive, but if you receive an email from a digital wallet company you use, be sure to double-check that the address is legitimate. Scammers will fake addresses that appear similar to official ones unless you look very closely.

Get to know your payment app's policies before use. If you receive a claim that you need to upgrade your account to accept payments, check the app's official website or contact customer service before spending or sending any money. Scammers often make up fake rules or policies to trick their victims.

When in doubt, back out. You are not obligated to accept an offer when selling on Facebook Marketplace. Keep an eye out for common red flags that you are being scammed and don't be afraid to block and/or report someone who you think might be trying to scam you or others.

Report scammers to Facebook Marketplace. If you spot a seller trying to pull off a scam or fall victim to one yourself, report them. Your report can help protect other users.

We have noticed a trend of increasing incidents of mail check fraud in our area in recent weeks. Mail check fraud occurs when a fraudster steals a check directly from your mailbox or the blue U.S. Post Office boxes and alters the amount on the check and/or the payee information on the check.

New Tripoli Bank recommends our customers take one of the following steps to avoid becoming the victim of mail check fraud:

- Set up online bill pay using our online or mobile banking tools, if you feel comfortable doing so. You can learn more about setting up automated bill pay here.

- If you want to continue mailing checks, we recommend you drop them off at your local Post Office or hand them directly to a USPS employee.

We also advise our customers write their checks out in gel or felt tip pen to help prevent the check from being altered. If you plan to use a blue mailbox to mail checks, try to deposit your checks around the time of the last mail collection of the day so the check does not sit in the mailbox for long.

If you have been a victim of a scam, whether it be check fraud or another scam, please reach out to New Tripoli Bank at 610-298-8811 and we can help you. You can also contact the U.S. Postal Inspection Service at 1-877-876-2455 or visit https://www.uspis.gov/report to file a report.

According to a survey put out by Lending Tree, 56% of Americans donated to charity in 2021. That generosity supports the various organizations putting these donations to work for health care, education, environmental protection, the arts, and numerous other causes.

Unfortunately, it also opens the door for scammers who capitalize on the goodwill of American citizens to line their own greedy pockets.

Every year, we hear about new scams involving faux fundraising for things like veterans, disaster relief, and other charitable causes. Scammers know how a sad story about someone rebuilding after a hurricane or someone coming home after serving our country can turn off the skeptical parts of our brains and get us to open our hearts and wallets to them. Charity scammers are especially active during the holidays since it's the biggest giving season of the year.

Consumers can protect their contributions and prevent becoming a victim by learning how to identify a charity scam.

Red Flags for Charity Scams

- Similar Sounding Name – Scammers will often use names that sound similar to legitimate charities to intentionally create confusion for consumers.

- High Pressure – Fraudsters will try to force a hasty decision by creating an atmosphere of immediacy. They may cold call, identifying you as a previous giver, and ask you for renewed support or to update your credit card information. In these situations, they are attempting to catch you off-guard and extract your financial information.

- 100% Guarantee – Every organization has some level of administrative costs. While most people want to ensure their donations are going toward legitimate program expenses, an organization that promises 100% of your funds are going directly to an individual in need might require additional scrutiny.

- Donation via Wire Transfer or Gift Card – Legitimate charities will not ask you to make payments via money order, wire transfer, or gift cards. If you are asked to pay by these means, hang up immediately. Never provide the information from a gift card over the phone or email; after verifying the legitimacy of the charity, take any gift card donation directly to the location of the charity and request documentation of your contribution.

Here are some tips that can help you avoid falling prey to a charity scam:

- Always research before giving!

- Visit the PA Department of State's online charities database to verify an organization's financial information concerning expenses for program services, fundraising, and management.

- You can check to see if an organization has been subject to corrective action by the Bureau of Corporations and Charitable Organizations by checking its enforcement and disciplinary actions page.

- Check whether an organization is registered with the Internal Revenue Service as a Tax Exempt Organization.

- Groups such as the Better Business Bureau (BBB) Wise Giving Alliance, Charity Navigator, and CharityWatch offer information and ratings about charitable organizations.

- Don't feel pressured to make a donation on the spot. Take time and do your research before sharing personal or financial information or sending money.

- Check websites very closely. Scammers can direct you to fake charity websites where personal and financial information are taken for nefarious purposes.

- Avoid wire transfer, money order, or gift card donations. Any requests for these kinds of payments should send up immediate warning flags.

- Direct your payment to the charity. Never make a check payable to an individual; write the check to a verified organization.

If you think you've been the victim of a charity scam, you should contact the PA Department of State's Division of Charities Investigation Unit/Audits at RA-STBEICIU@pa.gov or use the online complaint form. You should also file a report with the Federal Trade Commission at https://ReportFraud.ftc.gov and contact local law enforcement through non-emergency channels.

The jugger's dodge minivan pulling onto the street.

On November 18th around 11 AM, a bank jugging occurred at the ShopRite on Freemansburg Avenue in Bethlehem. The female victim, who had just left the Bank of America on Butztown Road and headed to the ShopRite, was followed by the depicted Dodge minivan, which had been parked next to the victim's vehicle at the bank, watching as the victim withdrew a sum of cash and put the envelope in her vehicle's glove box. Once at ShopRite, the person in the Dodge minivan waited for the victim to enter the store before exiting their minivan, smashing the victim's front passenger side window, and stole the envelope.

If anyone has any information relative to this incident, please contact Inv. Fox at (610)-419-9646 or email at efox@bethlehemtwp.com

This criminal act is referred to as "bank jugging." A criminal actor watches for people entering and leaving banks until they notice someone who they suspect has left the bank with cash on them. The actor then follows that person to their next location, before proceeding to take the money by force or breaking into the individual's car or home to steal the unattended cash.

The FBI offers several tips to avoid becoming a victim of bank jugging:

- Be on the lookout for individuals backed into parking spaces who do not exit their vehicle to conduct business.

- Be vigilant when using ATMs, as juggers typically target individuals using ATMs. However, individuals leaving the branch should exercise caution as they could also be targeted.

- Be vigilant when arriving and departing. Be aware of your surroundings and don’t leave your car or the building if you notice suspicious vehicles parked in or around the parking lot.

- Conceal your money before you leave the bank/credit union.

- Don't openly carry bank bags, envelopes or coin boxes.

- Watch for people following you.

- If you suspect you are being targeted/followed, call 911 and keep the dispatcher on the line to describe your location, where you are headed, etc. and keep driving until a marked police car finds you.

- Never leave a bank bag (hidden or not) in your car unattended.

Each year older adults lose billions of dollars to financial exploitation. Defined as the illegal or improper use of an older person’s funds, property or assets, elder financial exploitation (EFE) is a devastating crime. It not only impacts an elder’s financial situation, but often takes an emotional toll as well. Victims of such abuse frequently experience intense feelings of fear, depression, anger, and humiliation. In turn, abused elders may be at risk of poorer health outcomes and increased mortality relative to their counterparts.

Fraudsters prey on elders because as a whole, older adults possess more financial assets than other demographics. Seniors tend to own their own homes, have accrued savings over their lifetimes, generally have better credit and tend to be more trusting of others relative to younger populations. Consequently, criminals have engineered specific scams, such as the grandparent scam and other impostor scams, to target America’s elderly.

We have a larger resource page devoted to Elder Financial Exploitation that you can read to help you recognize the warning signs of abuse and provides resources you can use to protect those you feel may be victims of abuse. This article is simply meant to be a resource of the most commonly reported types of elder abuse scams.

Medicare / Health Insurance Scam

Every U.S. citizen over the age of 65 automatically qualifies for Medicare, so scammers do not have to research which health insurance provider they are using. The scam artists pose as Medicare representatives and try to get seniors’ personal information. They may offer services that the senior doesn’t need via the telephone or a “mobile unit” then try to bill Medicare for these fake or unnecessary tests/medications/etc. Seniors may get in trouble with Medicare or even be out money for “co-pays.”

Counterfeit Prescription Drugs

Mostly online scams, the FDA investigates upwards of 20 counterfeit prescription drug scams per year, up from five annually in the 1990s. Not only are seniors losing money on fraudulent prescriptions, but they may also harm themselves by taking unsafe substances rather than their real medication. Cheaper is not always better.

Funeral and Cemetery Scams

Scammers scour the obituaries or funeral home websites and reach out to survivors right before, during or right after the funeral to inform the bereaved family that the deceased owes a debt that was overdue at his/her death and needs to be repaid post haste to prevent besmirching the deceased’s reputation. The scammer plays on the grief of the bereaved family while seemingly being sympathetic. Another situation that can happen is that disreputable funeral homes will take advantage of grieving families who are unfamiliar with the details around funeral costs, adding on unnecessary or fraudulent extras to the bill. They play on the grief of the bereaved family by reassuring them that they want the absolute best for their loved one, including a very expensive casket for a cremation when only a cardboard box is required.

Fraudulent Anti-aging Products

In a society that stigmatizes aging, it is easy to understand why people may fall for scams that offer them the fountain of youth. Many older Americans seek out new treatments and medications to maintain a youthful appearance, putting them on scammers’ radars. Whether it’s the ever-popular fake Botox or fraudulent “homeopathic” remedies that do absolutely nothing, there is big money in the anti-aging business. Botox scams are particularly unsettling, because renegade labs creating versions of the real thing may still be working with the root ingredient, botulism neurotoxin, which is one of the most toxic substances known to science. A bad batch can have serious health consequences. As a result, the consumer may also have to incur unexpected medical expenses to address any adverse effects in addition to paying for the fake Botox.

Telemarketing / Phone Scams

Since many seniors are happy to talk to anyone willing to talk to them, phone scams are highly prevalent. Seniors also are more likely to purchase items over the telephone versus the internet, as a result, there is no paper trail, making these transactions almost impossible to trace. Also, once a scammer is successful with a telemarketing scam, s/he may “share the wealth” by spreading the susceptible senior’s information. There are several types of telemarketing scams including:

- The pigeon drop – scammer tells the senior they found a large sum of money that they are willing to split if the senior will provide a “good faith” payment by withdrawing money from their bank account. Often, there is a second con artist involved who portrays a “trustworthy” participant, such as a lawyer or officer.

- Fake accident – the scammer convinces the senior that a relative or close friend has been in an accident and needs the money for treatment.

- Fake charities – scammers will call seniors soliciting donations for fake charities. Names will be similar to well-known charities to create the belief that they are legitimate. These scams are particularly popular after natural disasters.

Internet Scams

Seniors fall victim to clicking on pop-up windows offering updated virus protection that look legitimate. They are scams that will either require a large sum to “purchase” or that upload an actual virus to the computer that grants the scammer access to personal information. The scammer may even install ransomware and demand a payment to let the senior regain control of their information. Email phishing scams are also popular. Someone pretends to be from their bank, the IRS or some other official entity that needs to verify the personal information of the senior. Seniors may also fall victim to a “Work From Home” money claim from an Internet ad or email. The offer may involve the senior needing to pay for “training” or special “equipment” to begin making the money.

Investment Schemes

When they retire, seniors are often looking for ways to maximize their savings while minimizing risks. Pyramid schemes, such as investment opportunities offered by a fabled Nigerian prince, are simply too good to be true. They are designed to take advantage of people and steal their financial resources. No legitimate investment will require up front money to reap astronomical returns within unrealistic timeframes.

Homeowners / Reverse Mortgage Scams

This encompasses two distinct scams. The first involves a con artist who poses as a tax official offering to reassess the senior’s property for tax purposes. The scam is predicated on the notion that the senior’s tax debt could be lowered. The con artist charges a fee for this “reassessment,” which is fraudulent. The second revolves around pressuring seniors to obtain a reverse mortgage to access the equity in their home. Typically, scammers are lurking to perform “necessary home repairs” to take advantage of the windfall of cash the senior receives from the reverse mortgage. Since real estate generally encompasses a large portion of a senior’s wealth, obtaining a reverse mortgage may effectively become the tool to deplete their largest asset.

Sweepstakes and Lottery Scams

While not limited to seniors, these scams use the lure of free money to convince consumers to divulge sensitive information or send funds to a con artist. Seniors receive a communication via email, mail, phone call or sometimes even in person. They have won a prize from some contest they don’t even remember entering. Before they can get the entire amount, they must deposit a partial amount to “verify” their bank account information. They are then asked to repay that amount to the scammer before the fraudulent check has been returned. By the time the check is returned as a fraud, the scammer is long gone with money they got from the senior.

Impostor Scams

This one seems particularly egregious because it can pull on the heartstrings of the senior involved depending on the persona adopted by the scammer. The scammer may call and pretend to be an IRS agent or from another official entity, such as the local utility company or even their bank. The scammer will then claim that the senior owes money that must be repaid immediately, or charges will be filed. Alternatively, the scammer may try a more personal approach by self-identifying as the senior’s favorite grandchild/niece/nephew/etc., in need of money. It may just be a “loan,” to address an urgent situation like a car repair, late rent, school tuition, or something along those lines. The scammer implores the senior not to tell mom or dad and states that s/he will pay the senior back. The scammer will then provide a Western Union or MoneyGram location to pick up the money.

Check Fraud

There are several variations of check fraud. The senior may write a check to someone, and that person alters the amount or orders checks with a new address to write fraudulent checks. Blank checks could be stolen and forged for any amount, or scammers could ask the senior for help “clearing” a check because s/he does not have a local bank account but needs the money quickly. The senior deposits the fraudulent check and writes one to the scammer. By the time the check is returned, the scammer and the money are long gone. The scammer may also write checks of larger and larger amounts with the senior until they get the amount they want, and then disappear.

In recognition of World Password Day, New Tripoli Bank would like to remind our customers and members of our community that they should be taking steps to safeguard their personal account information, including their password, and to make sure they know what to do if they suspect they have been affected by a reported breach.

With more consumers doing their shopping and financial transactions online, it is more important than ever to prevent cybercriminal activity, the bulk of which originates as phishing attacks and costs and estimated $17,700 every minute, according to a press release from the Independent Community Bankers of America. However, by staying alert and practicing proper cybersecurity, all of us can make a difference and ensure a safer and more resilient internet for everyone.

Reducing Your Risk

While there is no foolproof way to avoid online identity theft, you can minimize your risk by:

- Limiting what information you disclose—Never respond to texts, emails, or phone calls requesting sensitive personal information or financial information such as your banking ID, account numbers, username, or passwords, even if the messages appear to originate from your financial institution, government agencies, or officials from companies with whom you have a relationship. This is the most common form of phishing.

- Taking advantage of security features—Regularly update your computer security software and apply software updates to your computer system, mobile devices, web browsers and operating system when prompted. This will keep you up to date and improve your defenses against viruses, malware, and other online threats.

- Monitoring account activity—Carefully review your bank statements and regularly check your credit report for unusual or unexplained transactions, unknown accounts in your name, or unexpected denials on your card. Report any suspicious activity to your financial institution immediately.

Respond to a Data Breach

Unfortunately, data breaches do happen, which is why it's important to know the steps you can take to minimize your risk in the event of a breach.

- Consider a security freeze on your credit report to restrict access to your credit file. You can visit the credit reporting agencies websites or call them to put the freeze on your report:

- Equifax: Equifax.com | Phone: (888) 766-0008

- Experian: Experian.com | Phone: (888) 397-3742

- Trans Union: TransUnion.com | (800) 680-7289

- Set up a fraud alert, which directs banks to verify your identity before opening a new account, issuing an additional card, or increasing the credit limit on an existing account.

- Shred documents with personal or sensitive information before disposing of them.

- Change your passwords frequently and make sure to use strong passwords. A strong password is one that is at least 8 characters long and includes both capital and lowercase letters as well as numbers and symbols. You can watch our 2019 security seminar for more tips on cybersecurity.

- Report stolen financial information, accounts, or identities and other cybercrime to your financial institution, the Internet Crime Complaint Center and to your local law enforcement and/or state attorney general.

You can learn more about how to protect yourself online at the Stay Safe Online website.

Phishing scams have taken many forms throughout the years and it can sometimes be difficult to keep up with the new tools that hackers have developed to steal consumers’ personal and financial data. Since the internet boom in the early 2000’s, one of the more common methods has been creating domain names and web pages that are virtually indistinguishable from actual websites, then sending links to these websites to vulnerable users’ emails. 1,500,000 new phishing webpages are created per month, so it’s clear this problem is not slowing down anytime soon.

A recent alert from security specialists has drawn attention to cybercriminals who have developed a way to make these look-alike pages even more convincing. Scammers use a special tool that automatically displays your organization’s name and logo on the phony login page. They can even use this tool to populate your email address in the corresponding login field. This creates a false sense of security because many legitimate websites remember your username if you have logged in previously.

To add another layer of sophistication, savvy hackers will “spear phish” in an attempt to increase an email’s apparent legitimacy. Spear phishing involves researching their target so they can include personal information harvested from public sites like Facebook or Instagram in the email. Including these details is intended to trick consumers into overlooking the other more suspicious parts of the email and get them to click the links, open the attachments, or input their information into login pages.

While phishing is still very common and getting more sophisticated, so do fraud prevention techniques and technologies. There are two steps you can take to maintain your security: anti-phishing training and anti-phishing software. You should rely on either of these independently – but instead use them together to protect yourself.

Here are some anti-phishing habits you should become accustomed to in order to protect yourself:

- Never click a link in an unexpected email. Most important communication is either expected or will use more direct methods of contact.

- Remember that any site, brand, or service can be spoofed. Cybercriminals rely on your trust in a brand in order to get you to let down your guard.

- When you’re asked to log into an account or online service, navigate to the official website and log in. That way, you can ensure you’re logging in to the real site and not a phony look-a-like.

- Make sure you are using a secure internet connection. Before submitting personal information, ensure your connection to the website is secure by checking for “https://” in the address bar in your browser. If the site begins with “http://” the connection is unsecured. There should also be a “lock” icon in your browser’s status bar that verifies a secure connection.

- If your email doesn’t already have built-in fraud protection, you can look into third party security software for added protection. These programs are kept up-to-date so as the cybercriminals methods evolve, your protection will also keep up.

- Install a firewall. Firewalls prevent attacks on your computer from the internet by identifying malicious connections.

- Keep your browser, anti-virus, anti-spyware, and firewall up to date.

- Avoid emailing personal and/or financial information. Email systems are not encrypted by default and therefore your data could be intercepted by hackers.

This article uses information from https://www.revbits.com/blogs/lookalike-login-pages and "Scam of the Week" from https://blog.knowbe4.com/

The Federal Bureau of Investigation (FBI), Department of Health and Human Services Office of Inspector General (HHS-OIG), and Centers for Medicare & Medicaid Services (CMS) are warning the public about several emerging fraud schemes related to COVID19 vaccines. The FBI, HHS-OIG, and CMS have received complaints of scammers using the public’s interest in COVID-19 vaccines to obtain personally identifiable information (PII) and money through various schemes. We continue to work diligently with law enforcement partners and the private sector to identify cyber threats and fraud in all forms.

The public should be aware of the following potential indicators of fraudulent activity:

- Advertisements or offers for early access to a vaccine upon payment of a deposit or fee

- Requests asking you to pay out of pocket to obtain the vaccine or to put your name on a COVID-19 vaccine waiting list

- Offers to undergo additional medical testing or procedures when obtaining a vaccine

- Marketers offering to sell and/or ship doses of a vaccine, domestically or internationally, in exchange for payment of a deposit or fee

- Unsolicited emails, telephone calls, or personal contact from someone claiming to be from a medical office, insurance company, or COVID-19 vaccine center requesting personal and/or medical information to determine recipients’ eligibility to participate in clinical vaccine trials or obtain the vaccine

- Claims of FDA approval for a vaccine that cannot be verified

- Advertisements for vaccines through social media platforms, email, telephone calls, online, or from unsolicited/unknown sources

- Individuals contacting you in person, by phone, or by email to tell you the government or government officials require you to receive a COVID-19 vaccine

Tips to avoid COVID-19 vaccine-related fraud:

- Consult your state’s health department website for up-to-date information about authorized vaccine distribution channels and only obtaining a vaccine through such channels.

- Check the FDA’s website (fda.gov) for current information about vaccine emergency use authorizations.

- Consult your primary care physician before undergoing any vaccination.

- Don’t share your personal or health information with anyone other than known and trusted medical professionals.

- Check your medical bills and insurance explanation of benefits (EOBs) for any suspicious claims and promptly reporting any errors to your health insurance provider.

- Follow guidance and recommendations from the U.S. Centers for Disease Control and Prevention (CDC) and other trusted medical professionals.

General online/cyber fraud prevention techniques:

- Verify the spelling of web addresses, websites, and email addresses that look trustworthy but may be imitations of legitimate websites.

- Ensure operating systems and applications are updated to the most current versions.

- Update anti-malware and anti-virus software and conduct regular network scans.

- Do not enable macros on documents downloaded from an email unless necessary and after ensuring the file is not malicious.

- Do not communicate with or open emails, attachments, or links from unknown individuals.

- Never provide personal information of any sort via email; be aware that many emails requesting your personal information may appear to be legitimate.

- Use strong two-factor authentication if possible, using biometrics, hardware tokens, or authentication apps.

- Disable or remove unneeded software applications.

If you believe you have been the victim of a COVID-19 fraud, immediately report it to the FBI (ic3.gov, tips.fbi.gov, or 1-800-CALL-FBI) or HHS-OIG (tips.hhs.gov or 1-800-HHSTIPS).

For accurate and up-to-date information about COVID-19, visit:

- coronavirus.gov

- cdc.gov/coronavirus

- usa.gov/coronavirus

- fbi.gov/coronavirus

- justice.gov/coronavirus

- oig.hhs.gov/coronavirus

For most of us, the holiday season is about friends, family, food—and shopping! Black Friday and Cyber Monday fall just after Thanksgiving in the U.S., but internationally, they are two of the busiest shopping days of the year. Unfortunately, while you’re looking for holiday deals, the bad guys are looking for ways to scam you any way they can.

Follow these tips to stay safe this holiday season:

- Keep your smartphone, computer, and other devices updated. This helps ensure that your device has the latest security patches.

- Only use trusted Wi-Fi connections and be suspicious of any network that does not require a password to connect.

- Take the time to change any outdated or simple passwords. Use strong, unique passwords on all of your accounts.

- Be careful not to overshare on social media. Consider anything you post to be public information.

- Keep an eye on the activity in your banking and credit card accounts. Also, be sure to monitor your credit report on a regular basis.

- Be suspicious of emails you receive about online purchases. Check the status of your order directly on the website that you purchased from.

- If you receive a holiday greeting card in your inbox, verify the sender before clicking the link to view the card.

- If you’re traveling for the holidays, be sure to keep your devices stored safely at all times.

- Pay close attention to the websites that you order from. Only shop on websites that you know and trust.

- Watch out for giveaways and contests. Remember that if something seems too good to be true, it probably is.

If you plan to shop from the comfort of your home this year instead of heading out in-person to be the first in line for those door buster deals, make sure your home computer has the latest antivirus software updated. This will help protect you from hackers and identity thieves.

Once you’re ready to shop, make sure you:

- Take time to compare products. To get the best deal, compare products. Do research online, check product comparison sites, and read online reviews.

- Check out the seller. Confirm that the seller is legit. Look for reviews about their reputation and customer service, and be sure you can contact the seller if you have a dispute.

- Look for coupon codes. Search the store’s name with terms like “coupons,” “discounts,” or “free shipping.”

- Pay by credit card. Paying by credit card gives you added protections. Never mail cash or wire money to online sellers. If the seller asks you to pay this way, it could be a scam.

- Use secure checkout. Before you enter your credit card information online, check that the website address starts with “https.” The “s” stands for secure. If you don’t see the “s,” don’t enter your information.

- Keep records of online transactions until you get the goods, confirm you got what you ordered, and that you’re satisfied you won’t have to return the item.

- If you spot a fraud while shopping online this holiday season, report it to the FTC at ftc.gov.

Log In

Log In

Log into Online Banking

Log into Online Banking